Looking Good Tips About How To Find Out If You Have A Tax Offset

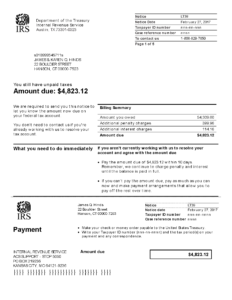

Installment agreements allow for the full payment of the tax debt over a period of time.

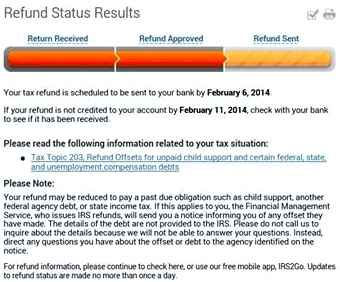

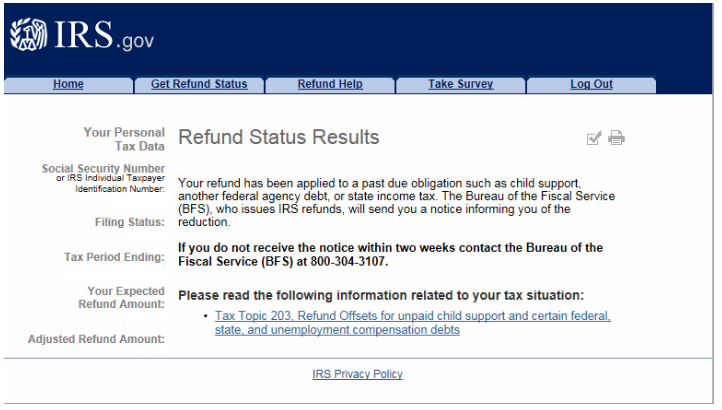

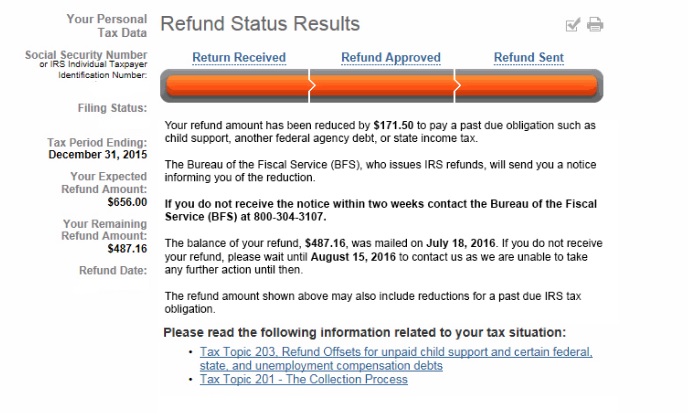

How to find out if you have a tax offset. All other offsets are handled by the treasury department’s bureau of the fiscal service (bfs), previously known as the. When you file your return, there's a chance that you may qualify for an income tax refund. But if your refund say approved with a.

You can call this number, go through the. You will need your personalized pin, above. Say you contribute 5% of your annual salary of $100,000 to your 401 (k) each year.

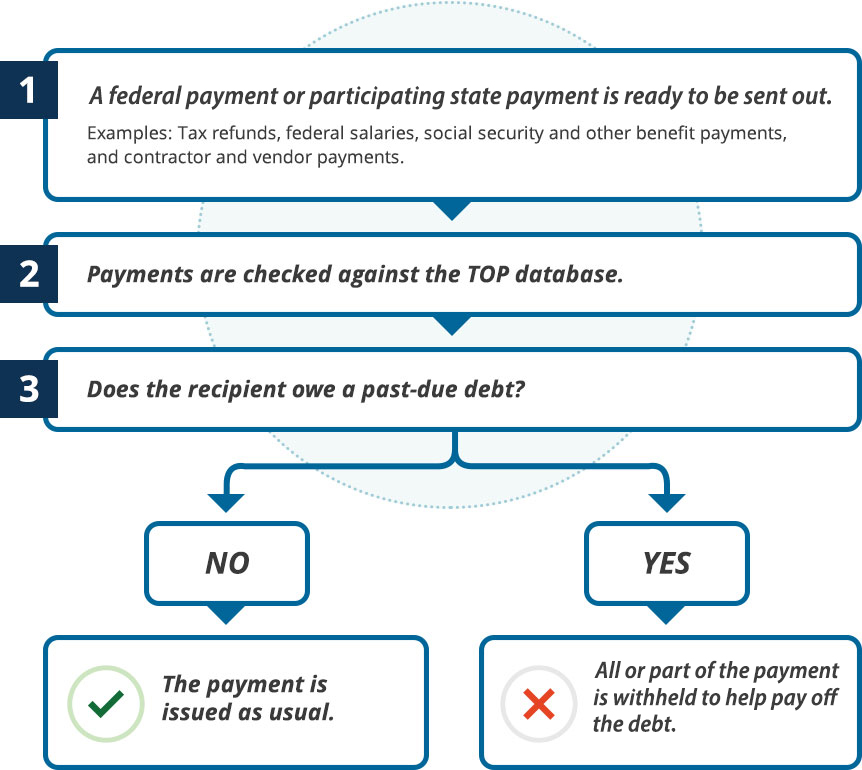

If you are wondering whether your federal tax refund will be taken by the irs as a result of debt, owed child support, or other reasons, here is how you can find out. How do i find out if i have federal tax offsets? The irs makes offsets for past due federal taxes.

You will not receive this refund until the irs processes your. Whether you owe taxes or you’re expecting a refund, you can find out your tax return’s status by: All tax tips and videos;

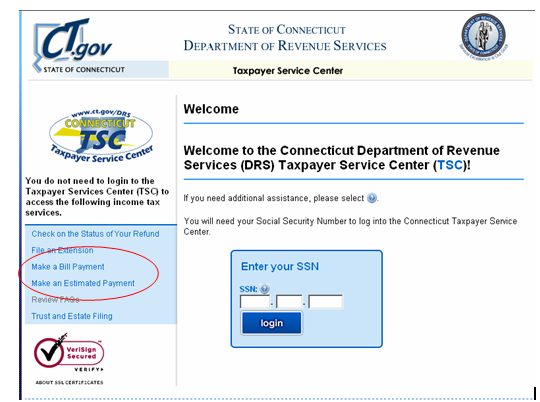

Using the irs where’s my refund tool viewing your irs account. To find out more, visit internet installment agreement. How do you find out if you have a tax offset online?

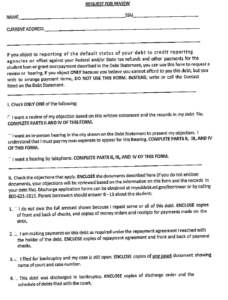

You may call bfs's top call center at the number below. If your refund has been approved with the whole amount that you was supposed to receive then your all set to receive it on your ddd date. You can contact the agency with which you have a debt to determine if your debt was submitted for a tax refund offset.